When it comes to obtaining a mortgage, many homebuyers turn to their bank as the first option. While banks can be a good choice for some, there are many reasons why using a mortgage broker may be a better option for you. Here are just a few of the advantages of using a mortgage broker:

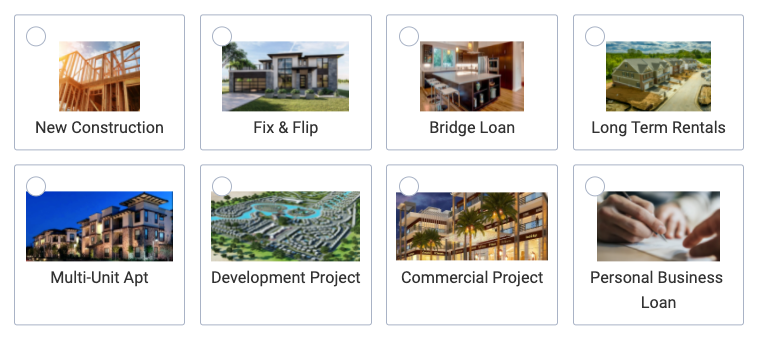

Access to a wide range of loan products: Mortgage brokers have access to a wide range of loan products from multiple lenders, including traditional banks and non-bank lenders. This means they can offer you more options than your bank may be able to. Brokers can help you find a loan product that meets your specific needs, whether you’re a first-time homebuyer or an experienced investor.

Expertise and guidance: Mortgage brokers are experts in the mortgage industry and can provide you with valuable guidance throughout the homebuying process. They can help you understand the different loan products available to you, explain the differences between fixed and adjustable-rate mortgages, and answer any questions you may have. They can also help you navigate the sometimes-complex process of obtaining a mortgage, from pre-approval to closing.

Save time and effort: Working with a mortgage broker can save you time and effort. Instead of having to research and apply for mortgages with multiple lenders, a broker can do this for you. This can be especially beneficial if you have a busy schedule or if you’re not familiar with the mortgage industry.

Potentially save money: Mortgage brokers can often help you save money by finding you the best possible interest rate and terms for your mortgage. Because brokers work with multiple lenders, they can shop around to find the best deal for you. They may also be able to negotiate on your behalf to get you a better deal.

Personalized service: Working with a mortgage broker can provide you with a more personalized experience than you may get from a bank. Brokers often work with a smaller number of clients than a bank, which means they can provide more personalized service. They can take the time to understand your specific needs and find a loan product that works for you.

Using a mortgage broker who is also a banker: Using a mortgage broker who is also a banker can provide you with the best of both worlds. They can offer you the wide range of loan products and expertise of a mortgage broker, as well as the convenience of closing loans which have great rates and sometimes with fewer fees.

In summary, using a mortgage broker can provide you with access to a wider range of loan products, expertise and guidance, save you time and effort, potentially save you money, and provide you with a more personalized experience. If you’re in the market for a mortgage, consider working with a mortgage broker who is also a banker to help you find the best possible loan product for your needs.