Understanding the DSCR Loan Product: A Guide for Borrowers

Introduction

As a lender, it’s essential to provide our clients with comprehensive information about the financial products we offer. One such product, gaining popularity among real estate investors and commercial property owners, is the DSCR Loan. DSCR, or Debt Service Coverage Ratio, loans are designed to evaluate a property’s ability to generate enough income to cover its debt obligations. This guide will explain the DSCR Loan Product, its benefits, how it works, and why it might be the right choice for your investment needs.

What is a DSCR Loan?

A DSCR loan is a type of commercial real estate loan that focuses on the income-generating capability of the property rather than the borrower’s personal income or credit score. The key metric used in these loans is the Debt Service Coverage Ratio, which measures the property’s net operating income (NOI) against its total debt service, including principal and interest payments.

Understanding DSCR

The DSCR is calculated using the following formula:

DSCR = NOI/TDS

- Net Operating Income (NOI): This is the income generated from the property after deducting operating expenses but before deducting taxes and interest.

- Total Debt Service: This includes all the principal and interest payments due on the property’s debt within a specific period.

A DSCR of 1 means that the property’s income is exactly enough to cover its debt obligations. A DSCR greater than 1 indicates that the property generates more income than needed to cover its debts, which is ideal for lenders. Conversely, a DSCR less than 1 suggests that the property does not generate sufficient income to cover its debt obligations, making it a riskier investment.

Benefits of DSCR Loans

1. Income-Based Evaluation

One of the primary advantages of DSCR loans is that they are evaluated based on the property’s income-generating potential rather than the borrower’s personal financial situation. This makes it an attractive option for investors who may have complex financial profiles or prefer not to rely on their personal credit.

2. Flexibility

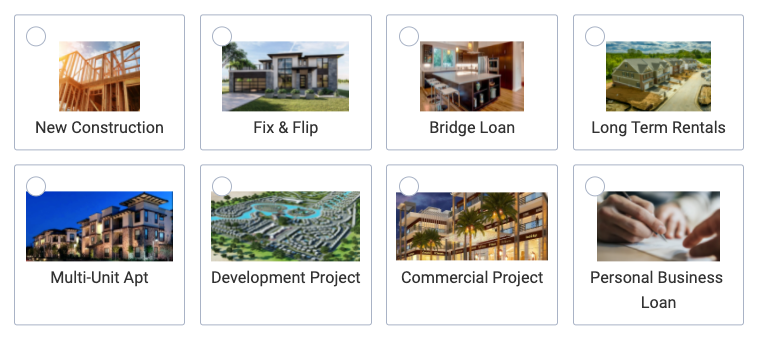

DSCR loans offer flexibility in terms of property types and uses. They can be used for various types of commercial properties, including multifamily units, office buildings, retail spaces, and industrial properties. This flexibility allows investors to diversify their portfolios and explore different income-generating opportunities.

3. Potential for Higher Loan Amounts

Since the loan amount is based on the property’s ability to generate income, investors might qualify for higher loan amounts compared to traditional loans. This can enable investors to finance larger or more lucrative properties, enhancing their investment potential.

4. Long-Term Financing Options

DSCR loans often come with longer loan terms, ranging from 10 to 30 years. Longer terms can result in lower monthly payments, making it easier for investors to manage cash flow and maintain the property’s profitability.

5. Streamlined Approval Process

The approval process for DSCR loans can be more straightforward and quicker than traditional loans, as the focus is on the property’s financials rather than the borrower’s personal credit history. This can expedite the financing process, allowing investors to seize opportunities promptly.

How DSCR Loans Work

1. Property Evaluation

The first step in obtaining a DSCR loan is the evaluation of the property’s financial performance. Lenders will assess the property’s net operating income, total debt service, and overall financial health. This evaluation includes reviewing rent rolls, lease agreements, operating expenses, and historical financial statements.

2. Loan Amount Determination

Based on the property’s DSCR, lenders will determine the maximum loan amount the property can support. Typically, a minimum DSCR of 1.2 to 1.5 is required for loan approval, though specific requirements may vary by lender.

3. Loan Terms and Conditions

Once the loan amount is determined, lenders will outline the terms and conditions of the loan. This includes the interest rate, loan term, amortization schedule, and any prepayment penalties. DSCR loans often come with fixed or variable interest rates, and the terms can be customized to meet the borrower’s needs.

4. Documentation and Approval

The borrower will need to provide documentation supporting the property’s financial performance. This may include financial statements, tax returns, rent rolls, and property appraisals. The lender will review the documentation and conduct due diligence to ensure the property’s financial stability and income-generating potential.

5. Closing and Funding

Once the loan is approved, the closing process begins. The borrower and lender will finalize the loan agreement, and the funds will be disbursed to complete the property purchase or refinance existing debt. The borrower will then begin making regular payments based on the agreed-upon terms.

Is a DSCR Loan Right for You?

DSCR loans are particularly well-suited for real estate investors and commercial property owners who prioritize the income-generating potential of their investments. If you are considering a DSCR loan, here are a few factors to consider:

- Property Performance: Evaluate the current and projected financial performance of the property. A strong and consistent NOI will increase your chances of loan approval and favorable terms.

- Loan Amount Needs: Determine if a DSCR loan can provide the financing you need based on the property’s income. Higher DSCRs can support larger loan amounts.

- Investment Strategy: Consider how a DSCR loan fits into your overall investment strategy. The flexibility and potential for long-term financing can align with growth and cash flow management goals.

- Risk Tolerance: Assess your risk tolerance and the property’s ability to weather economic fluctuations. A property with a higher DSCR provides a buffer against unexpected changes in income or expenses.

Conclusion

The DSCR loan product is an excellent option for real estate investors and commercial property owners seeking to leverage the income-generating potential of their properties. By focusing on the property’s financial performance rather than personal credit, DSCR loans offer flexibility, potential for higher loan amounts, and streamlined approval processes. If you are looking to finance your next commercial real estate investment, consider the benefits of a DSCR loan and how it can support your investment goals. As always, consult with a knowledgeable lender to explore your options and find the best financing solution for your needs. Make sure you check with your Account Executive today at www.NationalLendingPro.com or call us at 800-771-2758.