All across the US rates have been decreasing but those rates have not really hit the streets in true savings. Your usual bank rates at 2% and 3% are not really available to our average everyday hard working Developer or Builder. Those rates are geared towards consumer purchasers in our experience and usually if a qualified builder is getting any where near that 2% it is because he probably has his liquidity to shore-up the risk factor by a Wells Fargo or a Bank of America.

The old adage that banks will lend when you have money and when you really do not need their help. Why is that? Well they are what we call the sure bet money provider. They only lend on sure bets and builders and developers who really do not need them. So how about those high rates I am charged by a hard money lender or a private lender. Well the long and short of it is it is all based on “Risk”. What is the risk of a non-bankable borrower. Some would say it is high, and that 1-3 points really does not mitigate risk.

We at National Lending Pro see our relationship with Borrowers as a partnership. Are we charging 10-14% no we know those Hard Money Rates are way too high and really put the borrower at a disadvantage.

Speak to your Account Manager today to find out what your rate is and how we can partner with you to make sure you are funded.

About National Lending Pro.

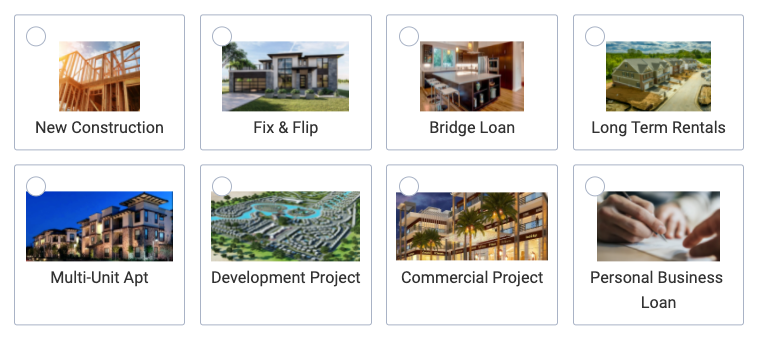

A Premier Private Lender funding Real Estate Investment loans on Non-Owner Occupied Real Estate Projects. Providing Non-Recourse and Recourse Fix & Flip, Ground-up, New Construction, Bridge Loans, Long Term Rental Loans, Short Term Rental Real Estate Loans, Real Estate Development Loans. Working with Capital Market Partners, Brokers, Correspondent lenders, Funds, and Private Investors, National Lending Pro funds non-bank loans exceptionally fast and with great terms. Providing the latest technology to its borrowers, partners and investors, National Lending Pro takes pride in calling itself a Technology Forward Thinking Lending Institution with cutting edge infrastructure to originate loans to both the experienced and novice Real Estate Non-owner Occupied Investor community.