As we dive into the year 2023, the landscape of interest rates continues to evolve, impacting various sectors of the economy. Understanding these interest rate conditions is crucial for businesses, investors, and individuals alike. In this blog post, we will delve into the current state of interest rates in 2023 and explore their implications for different stakeholders.

- The Federal Reserve’s Monetary Policy: The Federal Reserve plays a pivotal role in shaping interest rate conditions in the United States. In 2023, the Fed has adopted a cautious stance, closely monitoring economic indicators to determine its monetary policy. While the central bank has begun tapering its bond-buying program, interest rate hikes have been kept relatively moderate, aiming for a delicate balance between stimulating economic growth and controlling inflation.

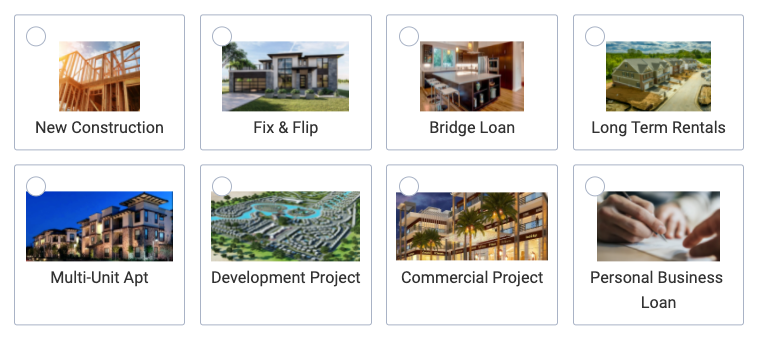

- Mortgage and Housing Market: Homebuyers and homeowners closely track interest rate movements, particularly in the mortgage market. As we enter 2023, mortgage rates have experienced a gradual upward trajectory, albeit at a measured pace. However, they remain historically low, presenting opportunities for prospective buyers and those considering refinancing their existing mortgages. It is essential to keep a pulse on these rates, as they can significantly impact the affordability of housing.

- Business and Commercial Loans: Interest rates for business and commercial loans in 2023 have seen slight increases compared to previous years. This change reflects the cautious approach taken by financial institutions to manage potential risks. As a result, businesses seeking financing should carefully assess the interest rate conditions and weigh them against their growth strategies and cash flow projections.

- Impact on Savings and Investments: The interest rate environment in 2023 has implications for savers and investors. Traditional savings accounts and fixed-income investments may yield modest returns due to relatively lower interest rates. This prompts individuals to explore alternative investment avenues, such as stocks, real estate, or other higher-yield assets, to potentially enhance their returns. However, it is crucial to strike a balance between risk and reward and align investments with long-term financial goals.

- International Factors and Global Markets: Interest rate conditions are not isolated to a single country but are influenced by global economic factors. Central banks worldwide respond to changing economic circumstances, leading to interconnectedness among global interest rates. Economic events in major economies, such as the United States, China, and Europe, can have a ripple effect on interest rate conditions across borders, shaping investment decisions and capital flows.

In 2023, interest rate conditions continue to evolve, driven by the Federal Reserve’s monetary policy decisions and global economic factors. Whether you are a prospective homebuyer, business owner, saver, or investor, staying informed about these interest rate conditions is vital for making well-informed financial decisions. Monitor market trends, consult financial professionals, and assess your individual circumstances to navigate the ever-changing landscape of interest rates successfully. Remember, knowledge and adaptability are key in harnessing the opportunities presented by interest rate conditions in 2023 and beyond.

Everyone and every situation is different. Make sure when you are ready to buy a property or start a construction project you speak to us at www.NationalLendingPro.com and find out how the interest rate horizon will directly affect you and your company.